Banana Gun Bot: The Multi-Chain Sniping Powerhouse

Should you buy BANANA or did you miss the train?

Decentralized exchanges (DEXs) have revolutionized crypto trading. These platforms offer trustless, permissionless trading without middlemen. As volume on DEXs has grown, so has the use of trading bots. Automated trading and sniping bots have become key tools for crypto traders. They execute trades faster than humans, giving users an edge in volatile markets.

These bots are especially useful for launch sniping – buying new tokens the moment they are released. Both newcomers and full time traders now rely on these bots to navigate the complex world of DEX trading. They have transformed how people interact with digital assets, making split-second trades possible in a 24/7 market.

The growing interest in trading bots in the DEX ecosystem was further underscored by the recent Binance listing of Banana Gun Bot, a trading bot that launched in 2023.

This development has sparked increased investor interest in the automated trading segment, highlighting the market's recognition of the potential these tools hold. However, as with any rapidly evolving technology in the cryptocurrency space, the rise of trading bots brings both opportunities and challenges. While there are many fundamentally strong and potentially undervalued automated trading solutions, the market has also seen its share of less reputable projects. Some have made exaggerated claims or false promises, underscoring the need for careful evaluation and due diligence when exploring this sector.

At Odysseus Ventures, we believe that these technologies are not just passing trends, but rather fundamental shifts in how we approach cryptocurrency trading. Their continued evolution promises to bring both innovation and disruption to the digital asset landscape, making them a critical area of focus for anyone involved in the cryptocurrency markets.

To support this view, we will explore the most prominent trading bot project, comparing its performance and market positioning with the one from competitors. We will then delve into a detailed analysis of key metrics, establishing a robust valuation methodology to assess the project fairly.

It’s important to note that this article is not intended as financial advice. Rather, it is meant to serve as a foundation for your own research and exploration.

How undervalued and revolutionary is Banana?

1. Key Features and Strengths

Banana has rapidly emerged as a frontrunner in the automated trading space, particularly excelling in the niche of newly listed token trading. Launched in early 2023 on the Ethereum blockchain, Banana has since expanded its reach to support multiple networks, including Solana, Base, and Blast, offering users seamless trading across various ecosystems. In addition to this, Banana Gun Bot has distinguished itself in the competitive landscape of trading bots through a comprehensive suite of features.

At its core, BANANA offers advanced automated trading capabilities, allowing users to implement sophisticated strategies with customizable settings for profit-taking and loss prevention. This flexibility empowers traders to fine-tune their approaches based on market conditions and individual risk tolerances. This flexibility, however, also leads to security problems.

These are a paramount concern in the volatile world of cryptocurrency trading, and get addressed with Banana’s robust protective measures. The bot boasts an impressive 85% success rate in anti-rug measures, significantly reducing the risk of falling victim to fraudulent projects. This feature makes Banana particularly interesting for sniping purposes.

This specialization in auto-sniping new tokens has been a key driver of its popularity and success. The bot employs unique first-block trading techniques, executing trades with exceptional speed and precision, often outpacing both manual traders and competing bots. This is particularly effective in volatile launch environments, where split-second decisions can make a substantial difference in trading outcomes

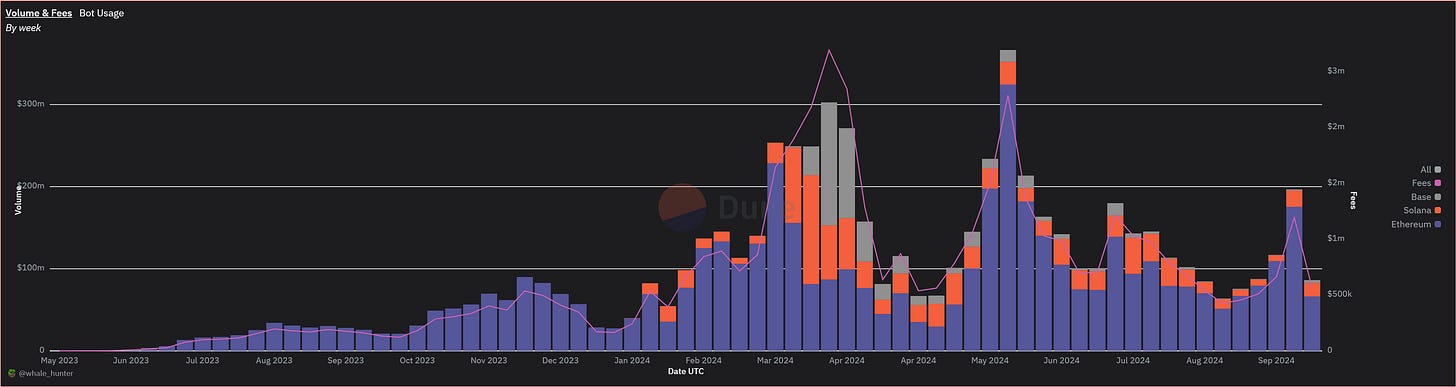

When looking at market share dominance, it becomes clear that these snipping capabilities lead Banana tp a impressive volume dominance on the Ethereum ecosystem.

However, when analyzing this metric across all blockchains a noticeable decline in market share dominance emerges. This downward trend is primarily attributed to its recent entry into the Solana ecosystem, where it faces intense competition from well-established trading bots such as BonkBot, BullX, Photon, and Trojan.

In addition to these snipping anti-rug capabilities, its MEV (miners, validators, or even bots that extract profits from traders by manipulating the order of transactions within a block, i.e., by frontrunning) resistant swaps provide an extra layer of protection.

The above mentioned points, together with the ability to set limit orders, enabling users to set predetermined buy or sell points, and to copy trade other traders, allowing less experienced traders to mimic the strategies of successful peers, make Banana one of the best tools you can use to navigate the DEX environment.

2. Financial and Fundamental Analysis

Banana’s financial metrics are impressive, particularly for a relatively new project. To make it short and concise, the most important statistics are the following:

Banana accounts for more than 3% of the total trading volume conducted through Ethereum front-end platforms

Banana is ranked among the top 15 protocols by revenue, generating over $50M+ of annualized revenue. 40% of this revenue is distributed back to $BANANA, Banana’s native token, holders, while the remaining 60% is allocated to the treasury and used to cover operational and expansion costs, as well as to buyback $BANANA, avoiding inflation. This leads to an annual yield of approximately 20%.

Cumulative trading volume and user amount exceeding $7.8bn and 725k, respectively

When compared to its main competitors, like Trojan or Photon, Banana seems to underperform.

However, these are limited to Solana, making them less adaptable to market shifts across chains. Furthermore, Banana’s revenues were obtained through organic growth. Instead of offering any backroom deals, such as special referral programs that guarantee an airdrop (thus increasing revenue and volume temporarily), Banana offers a blanket referral program, where the referrer gets 10% of the fees of his referees.

Another distinction is that, unlike the above mentioned competitors, the Banana team is in the process of developing a fully on-chain web application that offers an interface and user experience akin to centralized exchanges like Binance or Coinbase.

This platform will incorporate features such as lightning-fast execution, as well as advanced functionalities like limit and TWAP (Time-Weighted Average Price) orders. The web app is also being built to be cross-chain, allowing Banana to extend its reach beyond Telegram-based competitors and instead rival other established front-end platforms like 1inch, CowSwap, and Uniswap, potentially reshaping the landscape of decentralized trading.

Finally, Banana is the only project that has launched its own native utility token. As hinted above, $BANANA token holders benefit from a revenue-sharing model. In traditional finance terms, this structure is analogous to dividend payouts in the stock market, where shareholders receive a portion of a company's profits.

In the case of $BANANA, a percentage of the platform's revenue is distributed back to token holders, effectively allowing them to participate in the project's financial success. Specifically, 40% of the revenue generated by the trading bot is redistributed to stakers (holders that locked up their tokens). These rewards can be claimed in ETH, as well as in BANANA, where the required token amount is bought back from the market rather than issued from the treasury, preventing inflation and maintaining token value.

However not only stakers receive incentives. Traders also benefit from this native token due to the BANANA Bonus program, which allows bot users to receive a percentage of their trading volume back in BANANA tokens.

Users can hold these tokens, or burn them for Banana Credits. These credits can be exchanged for additional services, such as access to extra wallets, and the team plans to introduce more features like this in the future to encourage further token burning.

3. Tokenomics and Supply

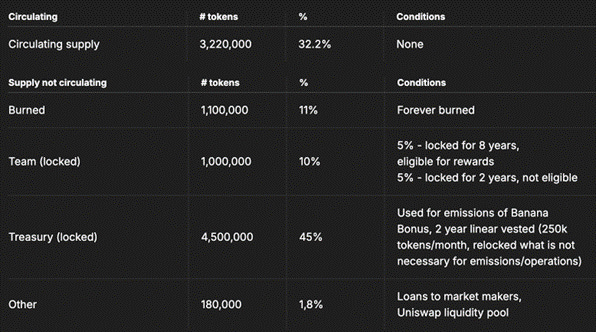

Before stepping into the valuation and fair value derivation, it is important to discuss the tokenomics.

In traditional finance, tokenomics can be compared to a company's capital structure and financial strategy. It encompasses the supply, distribution, incentives, and overall economic model of the $BANANA token. Similar to how companies issue shares, manage dividends, or engage in share buybacks, $BANANA’s tokenomics define how tokens are issued, utilized, and managed within its ecosystem. This includes how they incentivize participation, maintain value, and ensure the sustainable growth of the platform.

As of now, $BANANA has a circulating supply of 35%, representing 3.5 million tokens out of a total supply capped at 10 million tokens. This results in a current circulating market cap of $160 million and a fully diluted valuation (FDV) of $470 million.

At first glance, it might appear that a large number of tokens have yet to be released, but unlike many crypto projects burdened by venture capital (VC) involvement and strict unlock schedules, BANANA operates without any VC backing.

As you can see below, 45% of the tokens are allocated to the treasury,. These tokens were issued early in Banana Gun’s journey to be used as incentives if necessary, prior to the business generating significant revenue. Since then, the team has been transparent about its plans to burn these tokens as they vest and has already permanently burned about 11% of them.

Based on the current burn rate, it's estimated that 35% of the tokens will never be released. Additionally, 10% of the tokens are locked for the team for an extended period. This structure significantly limits potential selling pressure, making BANANA’s tokenomics more favorable for long-term value appreciation compared to VC-backed projects.

Now let’s start the fun part

3. Fair Value Derivation

In traditional finance, the comparable companies valuation technique is a commonly used method to derive the value of a company by comparing it to similar businesses. This technique operates under the assumption that similar companies will have similar valuation metrics. It involves analyzing key financial ratios and multiples such as the Price-to-Earnings (P/E) ratio, Enterprise Value-to-EBITDA (EV/EBITDA), and Price-to-Sales (P/S) ratio, among others.

Here, if the target company’s valuation multiples are lower than those of its peers, while its fundamentals remain strong, it may indicate that the company is undervalued.

Given the niche in which Banana is operating and that there do not exist similar tokens in this industry, we have selected projects from a variety of sectors to serve as comparables. In our case, the P/S ratio will be used for comparison.

Currently, BANANA appears to be undervalued when compared to the median of market multiples. Upon closer examination, the P/S ratio across the industry is approximately 25, while $BANANA is trading at a significantly lower P/S ratio of just 3.

To account for potential token unlocks in September 2025 and the competitive nature of the market, we applied a conservative 50% discount to this median ratio. Using the industry average as a benchmark, we estimate a fair value price for BANANA of $183, representing an upside potential of around 300%. However, the following question arises:

How high can $BANANA go? What if we get a full blown bull run?

To answer this question, we conducted a sensitivity analysis based on the derived P/S Ratio. The upper table shows target prices for given annual revenues and P/S Multiples, while the lower table indicates potential price increases in percentage. The grey-highlighted cell represents the price derived from current market/peer P/S ratios, reflecting current market conditions.

You can differentiate between two scenarios:

If you think there will be a general market appreciation, especially for alts (a so called alt season), this expectation is likely driven by the anticipation of a net positive influx of liquidity into the markets. This would increase the valuations of on-chain coins, ultimately raising both overall market P/S ratios and Banana's revenue (as fees increase when people buy more ETH meme coins and utility larps).

Depending on the magnitude of these increases, we project target prices between $321 and $485, representing percentage increases of 599% to 956%, respectively.

However, remember that during a full-blown alt season, price increases can become highly irrational (Do you remember DOGE, Axie Infinity, and all those Real Estate NFTs?). Therefore, the upper bound of $485 - based on the annualized revenue of March, the best-performing month of the year when we experienced a mini alt season - might quickly become too conservative of a target.

But what if the cycle is over?

If you are one of the people that believes the cycle is over, we have good news for you. Considering a overall market depreciation and taking Banana’s worst performing month, January (where SOL was not yet incorporated), to obtain an annualized revenue, you can see that the target price is expected to be $45.71, which only represents a 0.6% decrease from the current price of $46.

4. Conclusion — Is $BANANA a Buy?

Overall, at Odysseus we believe that the market is currently underpricing BANANA. The project not only ticks all the fundamental boxes but also serves as a robust money and yield generator.

Additionally, BANANA is one of the most held tokens by Smart Money wallets, as indicated by the strong accumulation trend, Smart Money wallets currently hold USD 30 million worth of BANANA, with minimal selling activity, reflecting a strong conviction in the token's long-term potential. Notably, major investors like Galaxy Digital have also accumulated the coi, further validating its market potential.

Given these factors, we give the yellow fruit a rating of Strong Buy.